Federal withholding calculator 2023

Enter your filing status income deductions and credits and we will estimate your total taxes. Federal Taxes Withheld Paycheck based estimate.

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator

Tax Withholding Calculatorfigure out the taxes withheld from your salary to see if youre going to receive a tax refund or owe the IRS.

. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. That result is the tax withholding amount. The amount of income tax your employer withholds from your regular pay.

And is based on the tax brackets of 2021 and. Type of federal return filed is based on your personal tax situation and IRS rules. Based on your projected tax withholding for the year we can also estimate your tax refund or.

In case you got any Tax Questions. The amount of income you earn. Tax Withholding Calculatorfigure out the taxes withheld from your salary to see if youre going to receive a tax refund or owe the IRS.

The Internal Revenue Service mandates employers to withhold tax from their employees salary so they can pay for their federal income. Information about Form W-4 Employees Withholding Certificate including recent updates related forms and instructions on how to file. Contact a Taxpert before during or after you prepare and e-File your Returns.

Tax Withholding Estimator 2022 - 2023. This calculator is integrated with a W-4 Form Tax withholding feature. Form 1040EZ is generally used by singlemarried taxpayers with taxable income under 100000 no.

TurboTax offers a free suite of tax calculators and tools to help save you money all year long. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. 2022 2023 Tax Brackets Rates For Each Income Level Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you.

This includes a Tax Bracket Calculator W-4 Withholding Calculator Self-Employed Expense. Form W-4 is completed by employees and given to their. 2021 Tax Calculator Exit.

It depends on. Tax Withholding Calculator 2022. 2022 Federal income tax withholding calculation.

For employees withholding is the amount of federal income tax withheld from your paycheck. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Ad Use The Tax Calculator to Estimate Your Tax Refund or the Amount You May Owe The IRS. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax. It will be updated with 2023 tax year data as.

Subtract 12900 for Married otherwise. IRS Tax Tip 2022-66 April 28 2022 All taxpayers should review their federal withholding each year to make sure theyre not having too little or too much tax withheld. Three types of information you give to your employer on Form W4 Employees Withholding Allowance Certificate.

Use that information to update your income tax withholding elections. Start the TAXstimator Then select your IRS Tax Return Filing Status. 250 and subtract the refund adjust amount from that.

250 minus 200 50. Then look at your last paychecks tax withholding amount eg. It is mainly intended for residents of the US.

The IRS hosts a withholding calculator online tool which can be found on their website. Calculate Your 2023 Tax Refund. You can use the TurboTax W-4 withholding calculator to easily walk you through your withholding adjustments and help you fill out IRS Form W-4 Employee Withholding Certificate.

To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4.

Investing Invest Early Invest Often Finance Tips Wealth In 2022 Investing Finance Finance Tips

Calculator And Estimator For 2023 Returns W 4 During 2022

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Income Tax Calculator How Much Tax Will Be Applied To Salaried People In New Budget

Paycheck Tax Withholding Calculator For W 4 Tax Planning

How To Estimate Your Taxes To Extend Filing Deadline Forbes Advisor

Calculator And Estimator For 2023 Returns W 4 During 2022

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator

W Va Revenue Secretary Explains Tax Cut Proposal Wvpb

Ubc2bgss5pxu7m

My First Million By 16th October 2023 How To Get Money Credit Card App Business Travel Outfits

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Tax Calculators And Forms Current And Previous Tax Years

Free Income Tax Calculator For Ay 2019 20 2020 21 Eztax In Help Filing Taxes Accounting Accounting Software

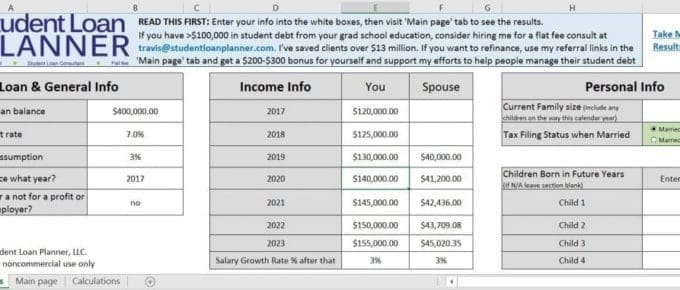

Biden Idr Student Loan Forgiveness Calculator 2022

Tax Estimators For 2022 Returns In 2023 Estimate Your Taxes

Us Tax Calculator 2022 Us Salary Calculator 2022 Icalcul